Tax bracket calculator 2020

This calculator helps you estimate your average tax rate your tax bracket and your marginal tax rate for the current tax year. On the next page you will be able to add more details like itemized deductions tax credits capital gains and more.

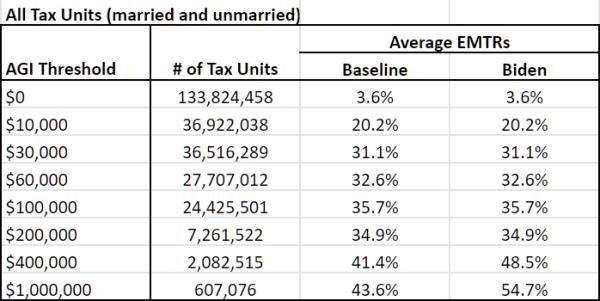

Joe Biden Tax Calculator How Democrat Candidate S Plan Will Affect You

This calculator shows marginal rates for the.

. Use our handy calculator to crunch the numbers and estimate how RRSPs make a difference. You can use our free Wisconsin income tax calculator to get a good estimate of what your tax liability will be come April. Self-Employed defined as a return with a Schedule CC-EZ tax form.

Find your total tax as a percentage of your taxable income. Normallyif a person dies between Jan. Testimonials are based on TurboTax Online reviews from tax year 2020 as well as previous tax years.

We will be able to determine your exact payment after a tax. Once you have the adjusted annual wages you can use the tax table found on page 6 of IRS Pub 15-T and calculate the annual federal income tax amount. Use our Tax Bracket Calculator to answer what tax bracket am I in for your 2021-2022 federal income taxes.

There are some slight changes but nothing major like we saw from 2017 to 2018 with the Trump Tax Cuts and Jobs Act. Reverse Québec sales tax calculator 2020. Our Ontario tax bracket table is shown exactly as we use it in our calculator with deduction of the Basic Personal Amount BPA.

Estimate Federal Income Tax for 2020 2019 2018 2017 2016 2015 and 2014 from IRS tax rate schedules. You can also use the excellent tax calculator that comes with an Acorns account or software like Turbo Tax. If the return is not complete by 531.

Finally you can make any needed tax adjustments for dependents and determine the amount of tax per check. A useful tax calculator. This only provides an estimate.

G2-G6 with your 2020 earning and tax estimation based on your current earnings and withholding. Income tax calculator for Ontario and Canada gross income of 2022 tax return that needs to be made in 2022. If taxable income is over.

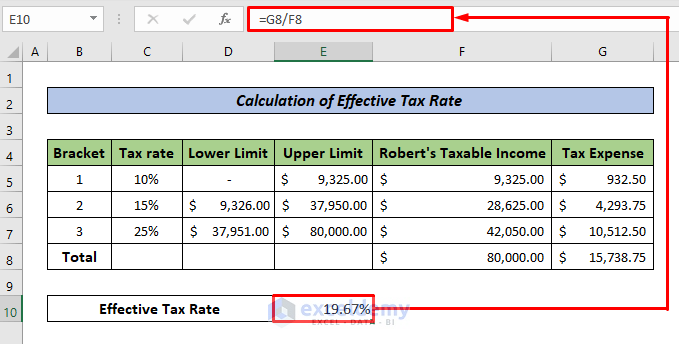

The table below shows the tax bracketrate for each income level. Its never been easier to calculate how much you may get back or owe with our tax estimator tool. For example if you fall into the 25 tax bracket a 1000 deduction saves you 250.

Tax Bracket Couple Marginal Tax Rate. 2020 Tax Brackets and Tax Rates for filing in 2021 Single. Based upon IRS Sole Proprietor data as of 2020 tax year 2019.

NATURAL PERSONS Maximum marginal rate. Which had them paying both halves of the tax. For 2020 the FICA limit is on the first 137700 of income.

Rates of Tax 2018 2019 2020. The tax credit remains at 30 per cent of the cost of the system. Base Tax Liability Total annual income x tax bracket percent.

Based on the tax bracket you enter the calculator will also estimate tax as a percentage of your taxable income. The tax bracket calculator is one of many FlyFin features geared specifically toward freelancers and the self-employed. William Perez is a tax expert with 20 years of experience advising on individual and small business tax.

But as a percentage of the whole 100000 your tax is about 17. Owners of new residential and commercial solar can deduct 26 percent of the cost of the system from their taxes. Figure the tentative tax to withhold.

RRSP contributions can help change your tax outcome. See this Tax Calculator for more The obvious way to lower your tax bill is to increase the untaxed area at the bottom of the diagram. 45 Reached at a taxable income.

Newfoundland and Labrador tax bracket Newfoundland and Labrador tax rates. Based on your annual taxable income and filing status your tax bracket determines your federal tax rate. 2022 Marginal Tax Rates Calculator.

2016 2019. The bottom line is that all the tax bracket upper limits went up a little bit. Tax Changes for 2021 - 2022 - 2020.

This puts you in the 25 tax bracket since thats the highest rate applied to any of your income. Sales tax calculator GST QST 2020. He has written hundreds of articles covering topics including filing taxes solving tax issues tax credits and deductions tax planning and taxable income.

2020 tax brackets and rates. Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income. Account for dependent tax credits.

He previously worked for the IRS and holds an enrolled agent certification. The AI-powered tax engine finds every possible tax deduction to minimize taxable income and keep taxpayers in the lowest tax bracket. Deductions lower your taxable income by the percentage of your highest federal income tax bracket.

Know how much to withhold from your. Estate income tax calculator. However any income is generated out of assests of estate income of the estate will be subject to an income tax separately.

Our tax refund calculator will show you how. Owners of new commercial solar. Calculator Variables and Results Tax Year.

For 2020 the Federal tax brackets are very similar to what you saw in 2019. Mortgage Tax Benefits Calculator. Your taxes will then be calculated based on the appropriate percentage of your income for your tax bracket.

10 of the amount over 0. Your tax bracket is determined by your taxable income and filing status. 31 2020 his estate may be subject to an estate tax on assets value after exempting 11580000 Please read more on estate tax.

Estimate your tax refund with HR Blocks free income tax calculator. Easily calculate your tax rate to make smart financial decisions Get started. In contrast a tax credit would deduct 5000 from the amount of taxes you owe or would.

Owners of new residential and commercial solar can deduct 22 percent of the cost of the system from their taxes.

Excel Formula Income Tax Bracket Calculation Exceljet

How To Calculate Foreigner S Income Tax In China China Admissions

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Net Income Income Tax Income

Inkwiry Federal Income Tax Brackets

Income Tax Calculator For Fy 2019 20 Fy 2020 21 Eztax In Help

How To Calculate Income Tax In Excel

How To Create An Income Tax Calculator In Excel Youtube

Teachers Income Tax Model Calculation For Ap Telangqana Employees It Calculator Tax Software Teacher Income Income Tax

How To Calculate Federal Income Tax

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

1 Uk Income Tax Calculator 2016 Salary Calculator Since 1998 Gross Salary Of 12000 2016 2016 201 Salary Calculator Income Tax Student Loan Repayment

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

Investment Property Excel Spreadsheet Rental Property Rental Property Investment Investment Property

Free Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

How To Calculate Federal Tax Rate In Excel With Easy Steps

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Budget 2020 New Income Tax Rates New Income Tax Slabs Income Tax Calculation 2020 21 Youtube